I-Sinar is the name of the facility that allows affected members of the EPF to withdraw a set amount of funds from their Akaun 1 in order to help with cash flow issues during the Covid-19 crisis. What is i-Sinar.

Epf Announces Terms For I Sinar Withdrawal

The liquidation of assets carried out by the Employees Provident Fund EPF remains based on the ordinary course of business of the EPF itself without any specific liquidation to cover the withdrawals under the i-Lestari i-Sinar and i-Citra schemes as well as the special one-off withdrawal of RM10000.

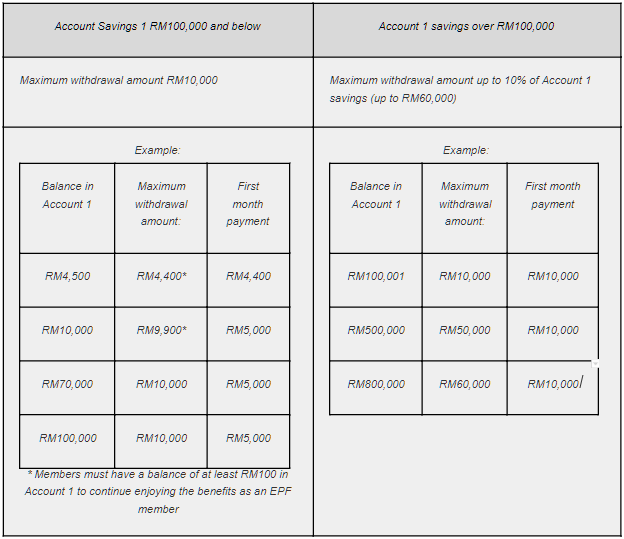

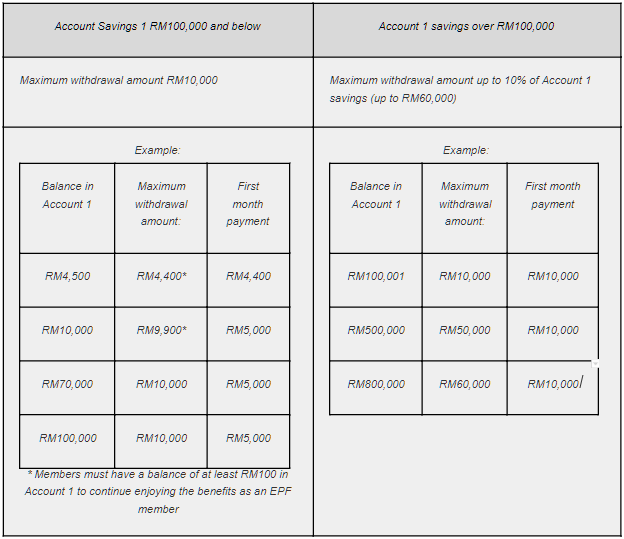

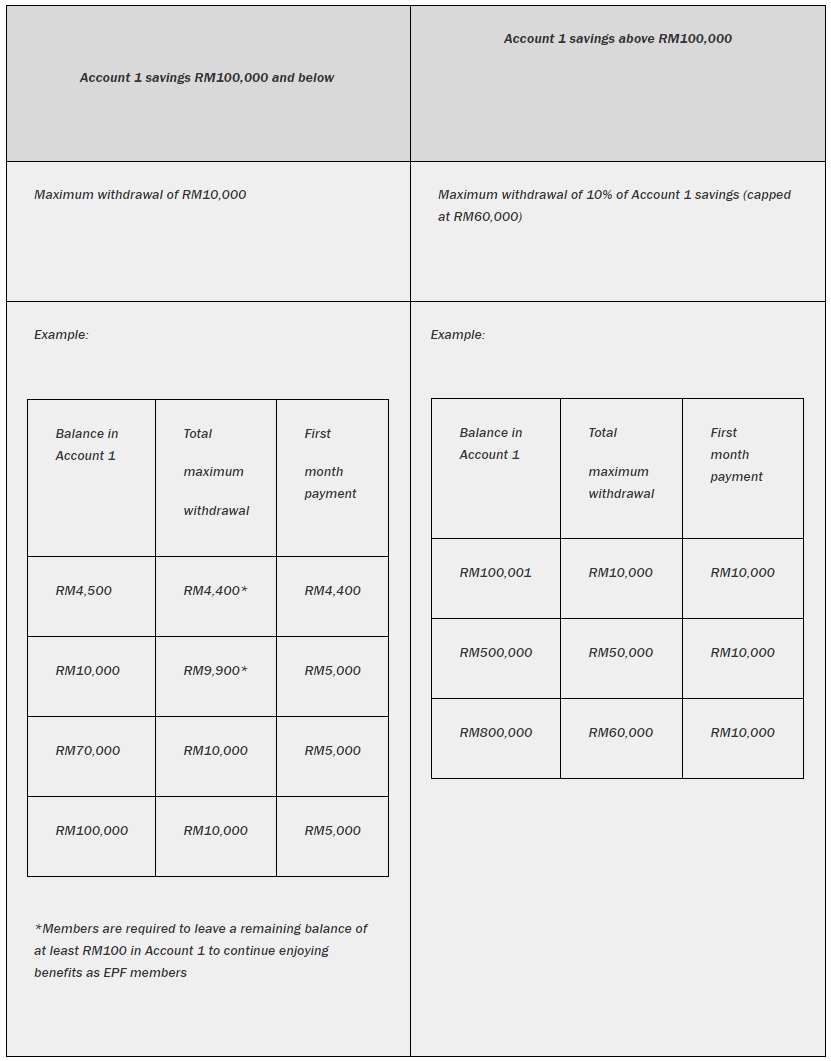

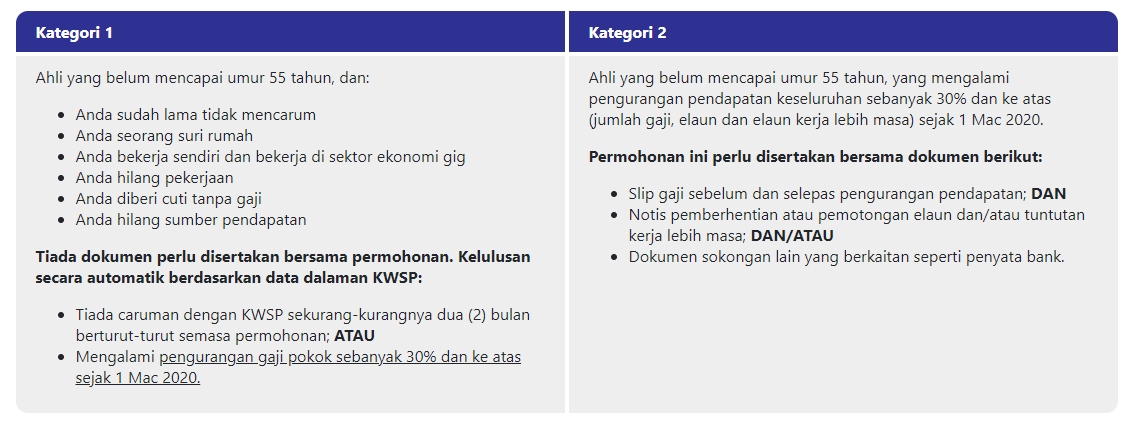

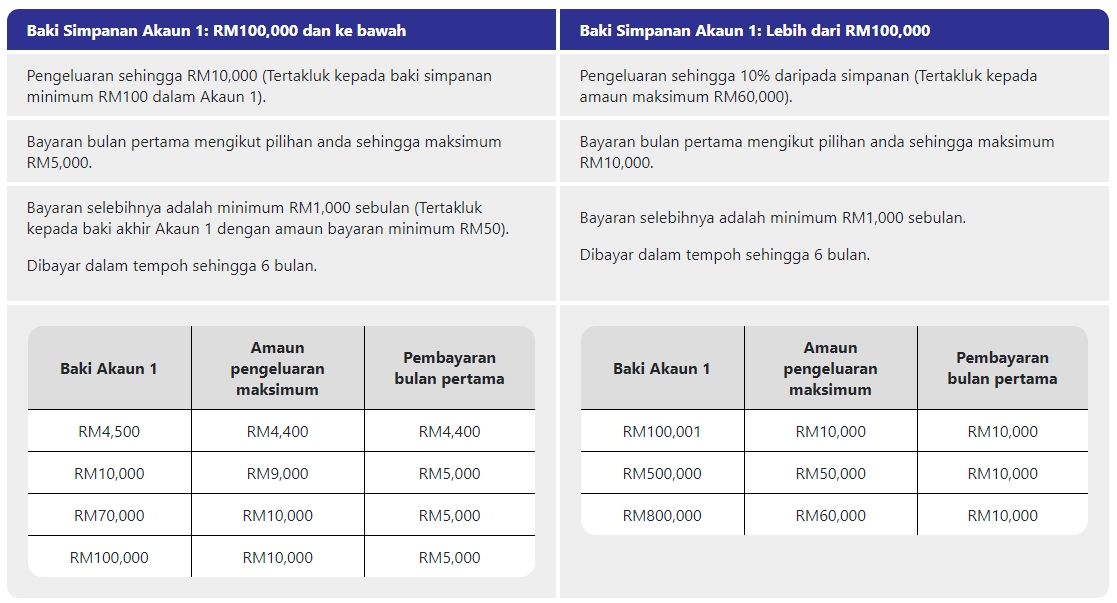

. For members that have RM100000 or less in Account 1 you are only allowed to withdraw up to RM10000. What is EPF Akaun 1. This initiative was launched by the EPF for the purpose of easing the financial burden of members whove been affected by the Covid-19 pandemic helping them sustain their livelihood.

Finance Minister Tengku Datuk Seri Zafrul Abdul Aziz has clarified that the Employees Provident Fund EPF did not liquidate any specific assets to fund the Covid-19-related withdrawal schemes that were offered to the public. Aside from that the EPF reminded that money withdrawn via i-Sinar must be replenished. Your EPF contributions are split into two different accounts.

Do note that you are only allowed to make the amendment. Finance Minister Tengku Zafrul Aziz stated in a written parliamentary reply that the EPF had liquidated assets in the. The move will benefit some eight million EPF contributors Finance Minister Tengku Zafrul Aziz said in the Dewan Rakyat today.

In general the withdrawal will add liquidity to the countrys economy and this should give a boost to economic activities as Malaysians have a high tendency to spend Yesterday the EPF said it expects the i-Sinar facility to benefit two million eligible members with an estimated advance amount of RM14 billion to be made available. The government has announced an extension of its i-Sinar programme to allow all Malaysians to withdraw funds from Account 1 of the Employees Provident Fund EPF. Payments will be staggered over a maximum period of six 6 months with the first payment of up to RM5000.

The i-Sinar withdrawal will be paid out across a period of 6 months. The EPF i-Sinar initiative enables EPF members to make a partial withdrawal from their savings in EPF Account 1. The withdrawal amount will vary depending on.

August 2 2022. After that the contributions will revert to the original ratio of 7030 for Akaun 1 and Akaun 2. The Employees Provident Fund EPF did not liquidate any specific asset to fund the i-Lestari i-Sinar and i-Citra schemes as well as the final one-off RM10000 special.

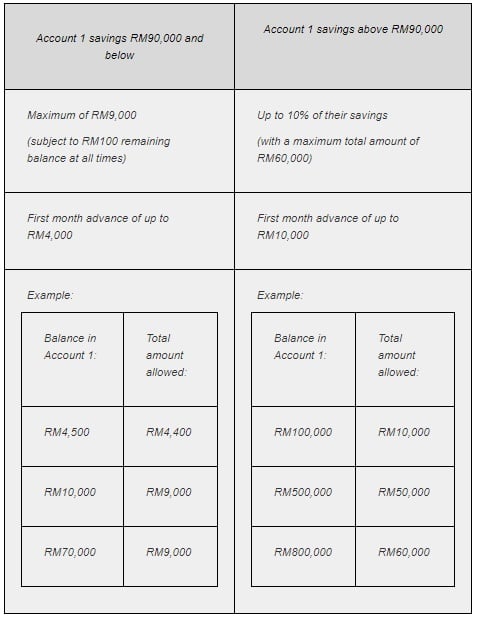

The Employees Provident Fund EPF has revealed full details for the i-Sinar program which will allow eligible members to make withdrawals from Account 1. The eligible amount for i-Sinar is subject to the members Account 1 balance based on the latest details below. Last April the Employees Provident Fund EPF did not liquidate any specific asset to fund the i-Lestari i-Sinar and i-Citra schemes as well as the final one-time RM10000 special withdrawal facility.

1Withdraw 20k i-sinar 2Follow TS stock purchase recommendation 3Bursa open all in 4Google search top 10 places to 14th floor. Jun 7 2021 1020 AM updated 2y. For those with they can withdraw any amount up to RM10000.

EPF members who fit the eligibility criteria can withdraw up to RM10000 or up to 10 of their Akaun 1 savings depending on their balance in Akaun 1. The i-Sinar program was introduced to assist members who are affected by the current pandemic situation. For those who have.

Affected members who wish to take out funds are able. EPF full withdrawal I Sinar 20 Bantu rakyat dengan duit rakyat. The move will involve some RM70 billion from the.

According to the provident fund all future EPF contributions of affected members will be channelled to their Akaun 1 until the amount taken out is replenished. To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies. The i-Sinar programme is a withdrawal facility introduced by the Malaysian government to help those facing financial difficulties due to the Covid-19 pandemic.

For those with more than RM100000 may withdraw up to 10 of their account balance with a maximum cap of RM60000. Akaun 1 and Akaun 2. These include the i-Lestari i-Sinar and i-Citra schemes as well as the RM10000 special withdrawal facility.

I Sinar Epf Allows Account 1 Withdrawal Up To Rm60 000 Here S How Trp

I Sinar Category 2 How To Apply And Eligibility Comparehero

I Sinar Epf Allows Account 1 Withdrawal Up To Rm60 000 Here S How Nestia

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

Bernama Epf Offers Further Details On I Sinar In Response To Media Query

Updated I Sinar Program Details Epf Members Can Start To Apply I Sinar Starting From 21 Dec 2020 News Puchong Co

I Sinar A Rm56bil Question Mark The Star

Epf I Sinar Applications Are Now Open For Category 1 Here S How To Apply

Epf Account 1 Withdrawal I Sinar The Pros And Cons

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

Epf Approves Rm19 62 Billion Worth I Sinar Applications Businesstoday

I Sinar The Pros And Cons Of Withdrawing Money From Your Epf Account Rojakdaily

I Sinar Category 2 How To Apply And Eligibility Comparehero

I Sinar 8 Other Things You Can Use Your Epf For

Epf I Sinar Account 1 Withdrawal Here S Everything You Need To Know Soyacincau

I Sinar Epf Allows Account 1 Withdrawal Up To Rm60 000 Here S How Trp